High yield stocks can lure the unwary investor into a sort of financial honey trap which follows the deceptive logic that ‘if a little is good, more must be better.’

The ‘yield’ in question is dividend yield. There is no question that a well-chosen selection of dividend-paying stocks can be an asset to any portfolio:

- Studies have shown that companies that pay dividends have more reliable earnings than those that don’t [Douglas J. Skinner and Eugene F. Soltes, professors at the University of Chicago and Harvard University, respectively].

- Over eight decades through 2010, dividends contributed 44% of the stock market’s return, according to Fidelity Investments. During the 1970s dividends generated 71% of returns.

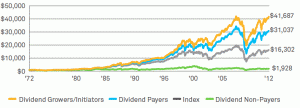

All this is true as is the following chart from Dreyfus showing that companies that grow their dividends outperformed the general market by 155% over the past 40 years [1972-2012] whereas stocks that did not pay dividends barely budged.

[Notes on chart: Growth of $1,000 invested in the S&P 500 Index (NYSEARCA:IVV) 1/31/1972-12/31/2012. Returns based on monthly equal-weighted geometric average of total return of S&P 500 component stocks, with components reconstituted monthly. Dividend Paying and Non-Paying dividend stocks are defined by each stock’s dividend policy that is determined on a rolling 12-month basis. A dividend-paying stock pays a cash dividend any time during the previous 12-months. For instance, if a stock pays a dividend on July 1, it will be classified as a dividend-paying stock through June 30 of the following year. Dividend Growers/Initiators is a subset of dividend-paying stocks and includes stocks that increased their dividend anytime in the last 12 months. Once an increase occurs, it remains classified as a grower for 12 months or until another change in dividend policy.]

Dividend stocks in general beat those that don’t pay dividends and the key measure for determining a stock’s dividend is the dividend yield. [Douglas J. Skinner and Eugene F. Soltes, professors at the University of Chicago and Harvard University respectively, concluded, “We find that the reported earnings of dividend-paying firms are more persistent than those of other firms and that this relationship is remarkably stable over time. We also find that dividend payers are less likely to report losses and those losses that they do report tend to be transitory losses driven by special items.] The dividend yield shows what percentage a stock returns in relation to its share price. It is calculated as the annual dividend per share divided by the stock’s price per share.

However, dividend paying stocks are subject to risks such as risk that the dividend could be cut, risk that the price of the stock could decline or lower-than average potential for price appreciation. [The yield is based on the dividend and the stock price. If the dividend itself increases, or the price of the stock decreases, then the dividend yield can go up.] In some cases, corporations which have some kind of difficulty will hike the stock dividend in order to attract yield-hungry investors.

While dividends provide income, it’s also worth noting that from a tax perspective, price appreciation may be more valuable than dividends because with price appreciation the investor is not taxed until the equities are sold. With dividends taxes kick in when the company pays out.

What Could Possibly Go Wrong?

As with all businesses, lots of things can derail dividend-paying companies. However, these are the things that tend to blindside investors.

Dividend Cuts: In the challenging last quarter of 2008 alone, 288 companies cut dividend payouts, according to Standard & Poor’s. By the end of 2009, another 804 dividend payments were cut by public companies in 2009.

Lessons: Stocks paying dividends are not guaranteed; the company’s board chooses whether or not to pay out cash dividends to shareholders. Also, note that not all dividend cuts are signs of looming financial catastrophe. Pfizer (NYSE:PFE), for instance, cut its dividend in half to fund its acquisition of Wyeth. Another action a company might take is to repurchase shares instead of increasing the dividend.

Dividends on borrowed time: While 2008-2009 proved that even financially sound companies can choose to circle the wagons and preserve cash, it’s fair to say that most dividend cuts happen for other reasons.

Dividends are paid out of cash, and if the company lacks cash it will have to fund the dividend either through debt or selling stock, neither of which is sustainable.

Lessons: Examine how a company has been funding its dividends and look for any threats to the cash supply such as high debt, or factors that restrict its use of cash (say a large portion of it is in tax havens and not available without triggering large taxes). You can do your own calculations or rely on analysts’ consensus.

Dividend rate not in line with company earnings: Following the concept that dividends are typically paid from cash, it’s evident that cash comes from earnings and future earnings will be tied to growth. Any threat to earnings and growth, therefore, could be a harbinger of a future dividend cut.

Lesson: Even with a company that has good cash flow, map both the earnings path and the annual dividend rate. If the earnings are far below the dividend rate, consider doing more research.

Mae West said “Too much of a good thing can be wonderful.” But when it comes to investing, a few high-yield dividend payers well-covered by free cash flow in your portfolio can boost returns and provide income. But, traps abound for the investor chasing high yield alone.