This year marked a huge switch in how some investors viewed emerging markets. In the early days of 2013 there were large net inflows, in the range of $10 billion. Almost immediately (still in January) the flows started to slow down and by May money started pouring out of companies associated with emerging markets [Source: Bloomberg “Emerging Markets Crack as $3.9 Trillion Funds Unwind”]. This happened for a variety of reasons but chief among those were investors’ fears that “easy money” being borrowed at little interest was drying up. According to Sujan Hajra, the chief economist at AnandRathi, “[T]here has been a considerable withdrawal of money in the emerging markets…since May,” even though the tapering process had not begun yet.

Although the sector has lost momentum, there’s no reason why the individual investor should completely bail out.

First, not all emerging markets are the same. The term emerging markets was coined by economists at the International Finance Corporation in 1981. Since then, although the term is ubiquitous, definitions vary widely. Some say emerging markets encompasses both maturing economies (such as China) along with less developed markets, such as Colombia or Lithuania. However, you can’t compare the state of development in places like Rwanda or Sri Lanka to Poland.

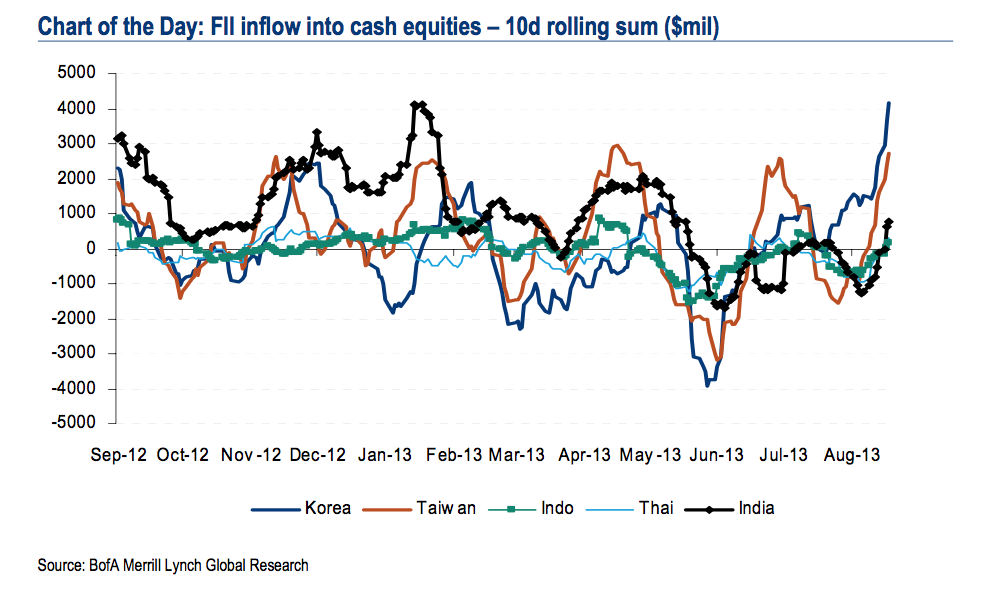

For this reason, even though money is leaving some countries, it’s not actually leaving all of them. On one hand, foreign selling of Thai, Indonesian and Philippine stocks has reached record levels.

On the other, money is still flowing into specific places, such as Korea’s equity market [Source: Wall Street Journal “Investors Prove More Selective in Latest Emerging Market Selloff].

Why is Korea popular? Korea is running a sizable current account surplus which has led to record high foreign currency reserves. That in turn gives investors confidence in comparison to countries which are running large current account deficits.

Second, it’s a mistake to view emerging markets as an “asset class” or a “strategy” in and of themselves because the countries in question are so different. In other words, you can’t call emerging markets an asset class any more than you can call US equities an asset class. Consider the BRICS (Brazil, Russia, India, China and South Africa) which are hardly identical: Brazil and Russia export oil while China and India are importers.

Each country, index and company deserves its own due diligence to avoid “throwing the baby out with the bathwater.”

Third, there are bargains still to be had. Korea, as noted, is bucking the overall trend. But even in countries and which have seen an exodus of money, there is still a strong argument for future growth. Depending on your individual investing time frame, for instance, China still has a strong growth story as does India. Both have huge, growing middle classes with more money than ever and a lot of pent up demand which will benefit the companies that can supply them with goods and services. In China, it can be argued that the growth story is not over, but it is evolving, from an economy based on exporting, to one based on domestic consumption. While it won’t likely sustain an 8-9% economic growth rate, investors often fail to put the likely 7% GDP growth in the proper context, which would be the envy of any of the world’s industrial economies.

It’s also important to note that equities are not the only way to diversify into emerging markets and fixed income should not be overlooked.

With fixed income investments, a country’s inflation can eat into the perceived gains. For instance, while India has a high interest rate, the value of its currency is falling which erodes returns for investors that have expenses primarily in dollars. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The MSCI Emerging Markets Index (NYSEARCA:EEM) equities started the year trading at an 8% discount to the MSCI World Index (TSE:XWD)– in other words the Emerging markets Index was valued 8% under World Index. [Notes: The MSCI Emerging Markets Index is a free float-adjusted market capitalization Index that is designed to measure equity market performance in the global emerging markets. The MSCI World is a stock market index of 1,606 ‘world’ stocks. The index includes a collection of stocks of all the developed markets in the world, as defined by MSCI. The index includes securities from 23 countries but excludes stocks from emerging and frontier economies making it

less worldwide than the name suggests. Both indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.] It has been discounted further since then – even as Emerging Markets Index earnings growth rate and return on investment remain a full percentage point higher than their developed market peers, according to State Street Global Advisors (data as of August 30, 2013). In short, the scale of the outflow doesn’t really appear to match up with real or perceived underperformance from emerging markets.

The individual investor can and should avoid joining the “herd” behavior in terms of all investments including those in or associated with emerging markets. Just like US equities, each equity, index, bond should be evaluated on its own merits as each country and region in the world should be considered distinct and not part of a broad, standardized class of investments. International and emerging market investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. Stock investing involves risks, including loss of principal and you should consult with your advisor about your specific situation prior to investing.