We often hear that the United States is a wealthy nation. But how wealthy, and amid the current turmoil and self-inflicted wounds, can it remain so?

Wealth In Ideas

To our credit, we believe in discovery and the ability of intellectual property to generate growth in the economy. Right now, U.S. investment in research and development is over $700 billion annually. The top companies on Nasdaq alone account for almost a third of this and the investment continues to pay off. IP-intensive industries now account for 41% of all U.S. economic output.

This number is always growing. In 1982 the public and private investments in R&D were just $80 billion.

But spending in the lab isn’t the end of the process, it’s the beginning. Companies in the U.S. take what they’ve developed, and put it to work in the form of capital expenditures, or CapEx. Last year, CapEx spending was $1.5 trillion and CapEx drives growth in earnings.

Wealth In Markets

Growth in earnings drives growth in share prices. At the turn of the century, the total value of stocks on U.S. markets was $15 trillion. Today it’s $46 trillion.

The total value of stocks in the world is $106 trillion, and the U.S. share, with just 4% of the world’s population is 43%.

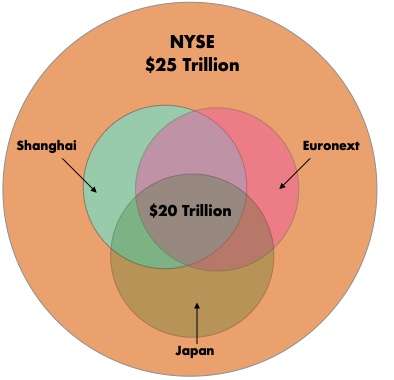

For context, the NYSE is more valuable than the next four of the largest stock markets located outside of the United States which are Euronext — the pan-European market — as well as the Shanghai, Japan and the Shenzhen stock exchanges. The Nasdaq is more valuable than the next three largest stock markets outside of the U.S.

Wealth in Our Pockets

Growth in the stock market creates two kinds of wealth. It creates portfolio wealth, or an increase in assets on individuals’ or companies’ balance sheets. It also creates wealth in the form of cash through dividends and interest.

Over the last 12 months, S&P 500 companies paid $580.2 billion in dividends, up from $552.4 billion in the prior comparable period. Dividend wealth is very stable wealth. War, pestilence, up is down politics notwithstanding, the cash keeps rolling in. To wit:

- The annual dividend wealth of $580 billion is about equal to the combined military budgets of China, Russia, Saudi Arabia and the United Kingdom.

- The dividends paid out in the last 12 months could fund the budgets of some of our most important government agencies: Education, HHS, HUD, Veterans Affairs, Energy NASA, Justice and Agriculture which come in at $565 billion.

- At their current rate of growth, dividends could fund the entire U.S. military budget of $770 billion in 2028.

All of this with a dividend yield of just 1.8% on S&P 500 constituents.

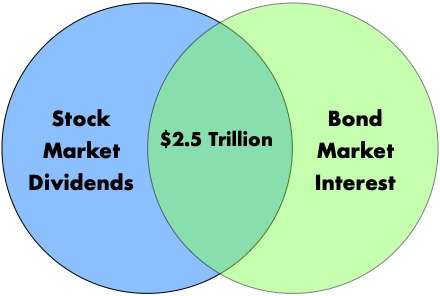

Oh, and don’t forget the bond market. There are $123 trillion in bonds outstanding of which $47 trillion are issued by U.S. companies. At an average 4% interest rate, that’s nearly $2 trillion returned to investors each year.

Combined, U.S. companies throw off $2.5 trillion in dividends and interest. With the U.S. gross domestic product at about $25 trillion, the U.S. economy is throwing off, after a fashion, a 10% dividend, an unheard-of yield.

The Virtuous Circle

What’s remarkable about these figures is just how modest the basic inputs are. A research and development tab of $700 billion is a big number, but it’s just a fraction of the $46 trillion of wealth tied up in the stock markets. Two and a half trillion in interest and dividends is another big number, but at just 1.4% of the $170 trillion in stock and bond markets, it’s almost a rounding error. Net, net a lot of wealth is being created that is just a fraction of our assets.

So, it’s not just that the United States is wealthy, but that it’s developed a remarkable engine that cannot be shut down easily and will be able to generate new wealth for generations.

So, the answer is that the United States is so wealthy that even with our serial, self-inflicted wounds, as well as pot shots from around the world, it would take generations to grind the engine of wealth we have created to a sputter. But our ambitions should rise above a grinding deceleration. We are standing on the shoulders of our forbearers, and should strive to ensure generations that follow can reliably stand upon ours.

This article was first published on Nasdaq.com. To see this and other articles on Nasdaq by David Evanson, click here.

Sources:

Size of stock markets globally

Total dollar value of dividends paid 2000 to 2023

2019 patent-driven economic activity

2012 patent-driven economic activity