There’s a lot of mergers and acquisitions brewing in the RIA business. That’s one takeaway from a recent conference hosted by Gladstone Associates, a boutique investment bank which advises RIAs on mergers and acquisitions.

In a two-day conference in early May, RIA principals representing approximately $320 billion in assets convened to discuss the opportunities and constraints in building their businesses through mergers and acquisitions.

The reason RIAs are a hot market for RIAs right now can be traced to two factors. First, there’s a push from succession planning. RIA principals that got into the business in the late 90s and early 2000 in the push away from commission products are now reaching retirement age. They need an exit.

Second, interest in the business from private equity investors is high. Two prized qualities that private equity investors look for in a business — recurring revenue and high margins — are abundant in RIAs. Remember, clients are charged a percentage of assets under management and these fees roll in like clockwork every quarter in the form of debits to client accounts. No pesky billing or accounts receivable to worry about. Further, because 10 professionals can manage, say $2 billion in assets with about the same amount of staff as $1 billion, there’s a lot of operating leverage if the business can achieve growth.

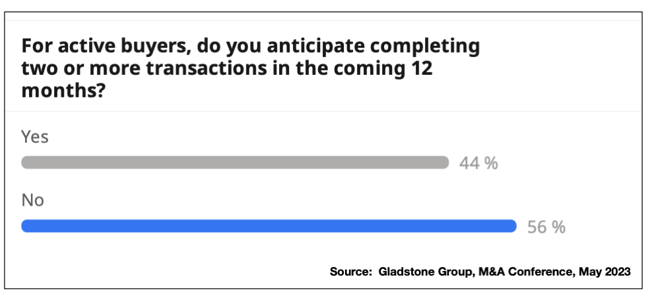

Testimony to the continued consolidation trend is that nearly 50% of the attendees reported they anticipated completing two or more transactions in the coming 12 months. One way to interpret this figure is that half of the industry wants to buy the other half.

Buyers and sellers noted the increasingly prominent role private equity capital plays in the RIA M&A landscape, creates advantages and challenges.

According to Daniel Kreuter, chief executive officer of the Gladstone Group who organized the conference said, “Private equity investors have definitely raised the ante, which is great news if you own or are building an RIA business.”

But on the downside, he noted that at current valuations, the stakes are higher for everyone, particularly non private equity-backed RIAs who are looking for growth through acquisitions and may be financing a deal using their balance sheet or borrowing money. “If a transaction goes south the impact is different for a private equity investor, versus, say a family-owned RIA who might be looking at M&A as a part of their succession planning,” Kreuter said.

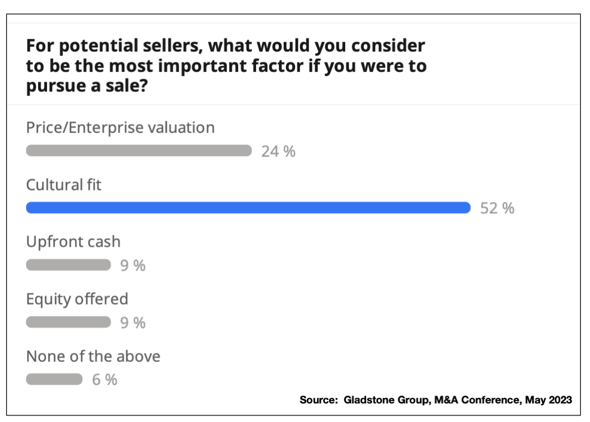

Of note, for sellers, the price they can get for their business was not their top concern: cultural issues are.

According to Derek Bruton, senior managing director of Gladstone, “The focus on culture is not surprising. “ He noted, “While buyers, in particular private equity investors, focus on dollars and cents, the sellers are motivated by a different set of factors. Founders and principals have nurtured their business for years. They have lasting and important bonds with their clients and employees. In this context, valuation matters, but so too, and perhaps equally, does finding a good home where the clients and employees can thrive.”

There is some evidence that RIA who have sold their firms to private equity or private equity-backed RIAs, have been pleased with the outcome. During an “ask the sellers” panel, principals who stayed with their firm after it was sold reported a positive experience. “We’ve had our best year of growth since the transaction,” said Mimi Drake, partner and co-market leader of Cerity Partners. Her former firm, Permit Capital, sold to Cerity, a $40 billion national RIA, in 2022.

Where the rubber may hit the road however is the experience of investors when their wealth manager changes hands. They may benefit when their assets are housed inside of a larger organization that has a larger menu of services, some of which they may need as they age and eventually retire. But against this benefit is a more institutionalized advisor. What was once a close, intimate bond with their advisor may be replaced by a more dollars and cents approach that could prove detrimental to the relationship. And as the RIA business is relationship-driven, this is a serious consideration.

Private equity investors are good at sizing up business opportunities, but, unlike the RIAs who are actually in the trenches running these businesses, they may miss the subtleties of things such as the importance of the bond between the advisor and client.

One other question also lingers regarding the presence of private equity in the RIA business. Are they getting it at the top? Remember, RIA revenues are a fixed percentage of assets under management. But what if the market goes into prolonged decline? What if some black swan event — there are several candidates, take your pick — cuts the market in half? De facto, RIA revenues would get cut in half too. And when that happens, what will private equity investors do? If they take the advice that is commonly issued by the firms they acquire, the PE investors will avoid trying to time the market, have a plan, and stick with it during upturns and downturns.

This article was first published on Nasdaq.com. To see this and other articles on Nasdaq by David Evanson, click here.